All Categories

Featured

Table of Contents

The are entire life insurance coverage and universal life insurance policy. expands cash money value at a guaranteed rate of interest and additionally via non-guaranteed rewards. expands cash worth at a repaired or variable rate, depending on the insurance provider and plan terms. The cash worth is not included in the survivor benefit. Cash value is a feature you make the most of while alive.

The plan lending interest price is 6%. Going this path, the passion he pays goes back right into his policy's money value rather of a financial organization.

How To Invest In Life Insurance Like Banks

The concept of Infinite Banking was produced by Nelson Nash in the 1980s. Nash was a money specialist and fan of the Austrian institution of economics, which promotes that the worth of items aren't clearly the result of standard financial frameworks like supply and demand. Instead, people value cash and products in different ways based upon their financial standing and demands.

One of the pitfalls of conventional banking, according to Nash, was high-interest prices on fundings. Long as financial institutions established the interest rates and funding terms, people didn't have control over their own wealth.

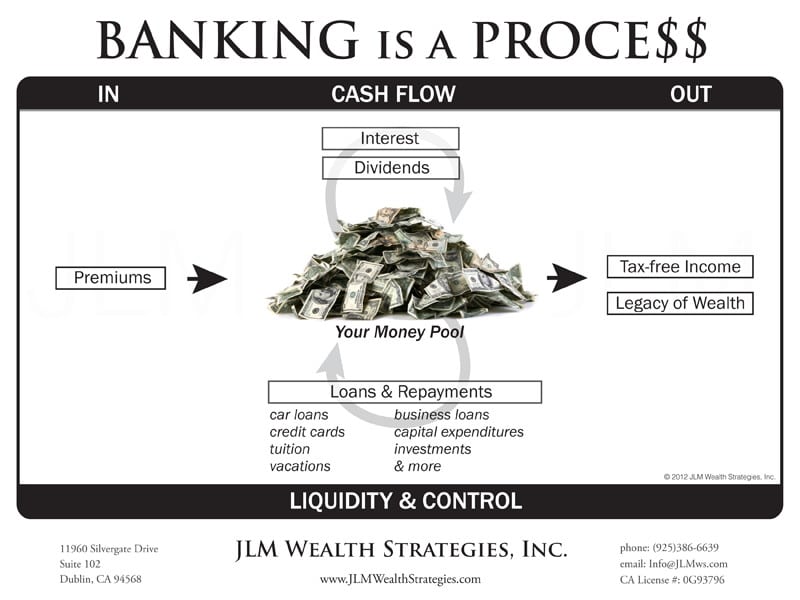

Infinite Banking needs you to possess your financial future. For goal-oriented people, it can be the finest financial device ever before. Below are the benefits of Infinite Financial: Arguably the solitary most valuable element of Infinite Banking is that it enhances your money circulation.

Dividend-paying whole life insurance coverage is really reduced threat and provides you, the insurance policy holder, a wonderful bargain of control. The control that Infinite Financial offers can best be organized into 2 categories: tax obligation benefits and property protections.

Infinite Banking Concept Reviews

When you make use of entire life insurance policy for Infinite Financial, you get in into a personal contract in between you and your insurance policy company. These protections may differ from state to state, they can consist of protection from property searches and seizures, security from reasonings and defense from financial institutions.

Whole life insurance policy plans are non-correlated assets. This is why they work so well as the monetary foundation of Infinite Banking. Regardless of what takes place in the market (supply, actual estate, or otherwise), your insurance coverage policy preserves its well worth.

Entire life insurance is that third container. Not just is the price of return on your whole life insurance coverage policy ensured, your death advantage and costs are likewise ensured.

Below are its primary advantages: Liquidity and accessibility: Plan fundings supply prompt accessibility to funds without the restrictions of traditional bank financings. Tax obligation performance: The cash money value grows tax-deferred, and policy finances are tax-free, making it a tax-efficient device for developing wealth.

Wealth Nation Infinite Banking

Property protection: In many states, the cash value of life insurance policy is protected from lenders, adding an extra layer of monetary security. While Infinite Banking has its qualities, it isn't a one-size-fits-all remedy, and it comes with significant disadvantages. Here's why it might not be the most effective technique: Infinite Financial frequently requires elaborate plan structuring, which can perplex insurance holders.

Think of never ever having to stress about bank finances or high interest prices once more. That's the power of boundless banking life insurance.

There's no collection loan term, and you have the freedom to pick the repayment routine, which can be as leisurely as paying back the loan at the time of death. This versatility encompasses the maintenance of the loans, where you can opt for interest-only payments, keeping the loan balance flat and manageable.

Holding money in an IUL taken care of account being attributed passion can frequently be far better than holding the money on deposit at a bank.: You have actually constantly imagined opening your own bakery. You can obtain from your IUL plan to cover the preliminary expenses of renting out a space, acquiring tools, and working with staff.

Allan Roth Bank On Yourself

Personal loans can be gotten from traditional financial institutions and credit rating unions. Below are some bottom lines to take into consideration. Credit report cards can provide an adaptable method to obtain cash for very short-term durations. Obtaining money on a credit history card is usually very pricey with yearly percentage prices of rate of interest (APR) commonly reaching 20% to 30% or more a year.

The tax obligation therapy of policy finances can differ significantly depending on your nation of home and the specific regards to your IUL policy. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan finances are usually tax-free, using a significant advantage. Nonetheless, in various other territories, there might be tax ramifications to consider, such as possible taxes on the financing.

Term life insurance policy just gives a survivor benefit, without any kind of cash money worth accumulation. This means there's no cash value to obtain against. This write-up is authored by Carlton Crabbe, Chief Exec Officer of Resources permanently, a professional in supplying indexed global life insurance policy accounts. The information given in this write-up is for instructional and informational purposes only and need to not be construed as monetary or financial investment suggestions.

For financing policemans, the extensive guidelines enforced by the CFPB can be seen as troublesome and limiting. Initially, car loan policemans typically say that the CFPB's regulations produce unnecessary red tape, bring about more documentation and slower lending processing. Policies like the TILA-RESPA Integrated Disclosure (TRID) regulation and the Ability-to-Repay (ATR) needs, while intended at protecting customers, can bring about delays in shutting bargains and increased functional prices.

Latest Posts

Allan Roth Bank On Yourself

How Do You Become Your Own Bank

How To Invest In Life Insurance Like Banks